The larger DeFi category has produced a number of cryptocurrency market winners over the past year, but few have become as dominant as Uniswap.

Not only has the associated UNI token performed incredibly well itself, Uniswap’s dominance has meant that DEX volume has increased more than 1,000 times since then last year. What is behind this explosive trend and when – if at all – will it end?

DEX trading volume grew more than 1000 times in the last year

The “DeFi Summer” 2020 put the category on the map and spawned the next wave of altcoin all-stars. At the end of the extremely hot trend, Uniswap unveiled its UNI token, which has since increased 700% from the November low.

Related reading | Millions learn more about DeFi from the wheel of fortune candidate

Demand for the token is rising, signaling that magic is happening on the platform itself, and investors know it.

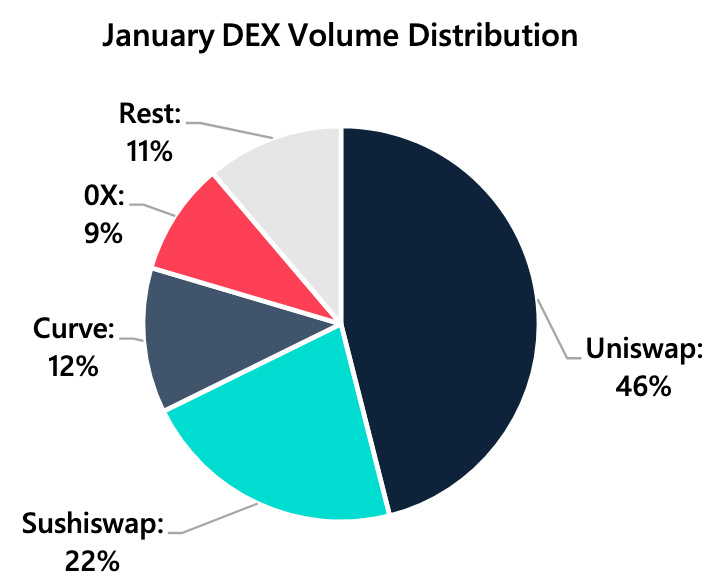

Uniswap dominates all other DEX platforms, driving 1100% increase Source: Dune Analytics

Uniswap not only saw an increase in trading volume, but the total volume of the decentralized exchanges (DEX) rose over 1,100 times over the previous year from USD 39.5 million to USD 43.5 billion. This emerges from the latest monthly report from Arcane Research.

All major platforms have risen from the growing interest in the crypto market, but few have dominated as much as Uniswap. Uniswap accounts for 46% of the total, or nearly $ 20 billion.

The platform represents nearly half of the total DEX volume Source: Arcane Research

Decentralized exchanges like Uniswap allow investors to quickly and easily exchange one token for another, using a private Ethereum wallet.

The rise and dominance of the DeFi platform Uniswap

Exchanges of this type have been around for a while, but Uniswap’s unique setting, Unicorn logo, and vibrant colors made sure investors started actually taking advantage of them.

Uniswap’s brand strength and the fact that it is thriving as a platform has resulted in similar demand for the native UNI token. The buying frenzy has brought the token below $ 13, from below $ 1 per token.

Uniswap is up over 700% from November low | Source: UNIUSDT on TradingView.com

A large part of the UNI tokens was initially given away free of charge. At the time, the 400 free UNIs valued at around $ 3 per token were essentially the form of a stimulus check in the cryptocurrency market.

Related reading | Altcoin Expert: Buy A Crypto That Will Last During Bitcoin Crash

What stimulated it, however, was the platform and token longevity, solidifying it as a major competitor in the DeFi space. The 1,100-fold growth in the decentralized stock exchange volume compared to the previous year is proof of its effectiveness and for the young, up-and-coming brand only the beginning.

Featured image from deposit photos, charts from TradingView.com