- Oracles are necessary to bring data and information outside the chain into the blockchain

- Money’s Oracle blockchain technology builds the mechanisms used in the old financial system for the cryptocurrency space

- Money is also working on the decentralized financial equivalent of a credit score, which provides a user’s DeFi history for credit logs

Use trust in your old financing.

In the existing financial system, there are protective measures and measures that reduce the risk accordingly in order to prevent financial institutions from lending to overfunded borrowers. A borrower’s credit score, along with their benchmark rating, determines the likelihood of their ability to repay a loan. This applies to personal loans, mortgages, lines of credit and all other products offered by the existing banking infrastructure.

Currently, the advent of DeFi in the cryptocurrency space has sparked an entirely new way of interacting within a financial system separate from the old system that has been keeping its thumbs-out on the public engaging with it for so many years. This has led to the so-called DeFi revolution. At the time of this writing, the DeFi Pulse (defipulse.com/) measured DeFi USD Total Value (TVL) in USD is just over $ 22 billion. This would mean a growth of 3190% compared to the previous year. Most of that over 100% growth, which pushed the bar from $ 11 billion to over $ 22 billion, happened in the past 90 days. There has never been a sector that has seen anything close to this growth.

Of course, when something grows so quickly – be it an industry, sector, organization, or otherwise – there are oversights or flaws in the infrastructure that is holding it back. In the case of DeFi, we clearly see a desire to deal with protocols. However, the collateralized debt position ratio is still quite uneven and arbitrary. A user with an exceptional history of paying back loans on time, avoiding defaults, and engaging in trustworthy and prudent behavior will be placed in the same category of DeFi users who will participate in the absolutely opposite behavior.

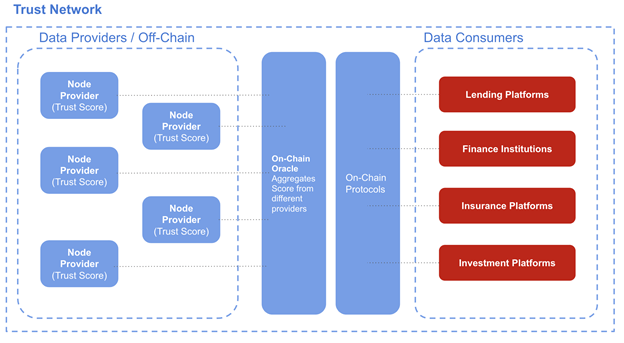

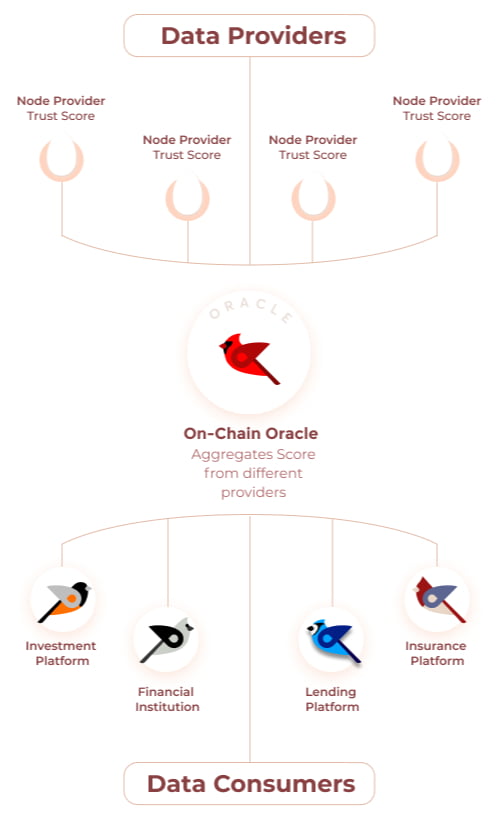

Enter Bird.Money, its Oracle and the Trust Network.

There are oracles. Then there are bird oracles.

For those who are just entering the fascinating world of cryptocurrency and decentralized financing, an Oracle delivers data from outside the blockchain into the blockchain. This may seem like a rudimentary explanation, but it is more nuanced than what might appear to begin with. The reason for this is that blockchains themselves act as silos, as it is actually difficult to take into account data from outside the blockchain without a transmission source that can communicate with the blockchain itself. In this case, Oracle offers the necessary function to deliver information and data from outside the blockchain, such as prices, ratings, analyzes and other information, to blockchain infrastructures in a tamper-proof manner.

1.Bird.Money Oracle 2.Off-Chain Analytics

Bird.Money, Oracle’s blockchain is developing the tools and mechanisms needed to move DeFi, as the newest, most trusted financial system, into the next phase of its evolution. By creating an off-chain Oracle data analytics platform for the Ethereum blockchain, Bird Oracle connects external services and investors with low risk and guarantees to the decentralized credit and financial market. Bird analysis is used to aggregate and validate off-chain metrics to obtain consensual data from multiple data points. Borrowers can then take advantage of “good” behavior as they go through their interactions with DeFi protocols – loans that are repaid on time, not overfunded, not prone to scams or “carpet pulls” where liquidity is quickly drawn from the decentralized exchanges is removed and caused a crash token price and overall tax prudent with their digital assets. This good behavior could then be used to borrow more assets for less advance security, effectively reducing your collateralized debt position (CDP).

Bird.Money also sets up the Trust Network to provide a Trust Score to the credit logs. The DeFi equivalent of the legacy banking system’s credit score, which provides a user’s DeFi history linked to their ETH address to the lender or credit log. This would be a much-needed risk reducer to ensure that borrowers with an unfavorable trust score need to provide more collateral, increasing their CDP to avoid default. It’s a win-win situation for both parties. Borrowers who have done well throughout their DeFi history are rewarded for having to provide less collateral for interactions with a credit log. Loan logs maintain some form of assurance about that user’s good behavior, which in turn attracts more educated DeFi users to the log and allows them to take the necessary safeguards against those who show otherwise.

Blurring the lines

It cannot be emphasized enough what role the Bird.Money Oracle and Trust Network will play in bridging the gap between the legacy and the decentralized financial system. This is especially true when we consider recent changes to U.S. government regulations that now allow older institutions to participate in the use of public blockchains. The lines between the two rooms, both central and decentral, are constantly blurring. Bird.Money is well positioned to lead the way into this next frontier of fairer, more inclusive financial infrastructure.

For more information, see the recently updated roadmap for 2021, which clearly positions Bird.Money’s Oracle platform and Trust network with a specific and necessary use case for the DeFi sector.

RoadMap: https://link.medium.com/KzD8cCdJMcb

Dextools: https://www.dextools.io/app/uniswap/pair-explorer/0x6d76f7d16ca40dd13e52df3e1615318f763c0241

Uniswap: https://info.uniswap.org/pair/0x6D76F7d16CA40dD13E52dF3E1615318f763c0241

Demo:

Off-Chain Oracle Analytics (test network): https://oracle-analytics.bird.money/

Go through video: https://vimeo.com/495795587

Credit platform: https://lend-beta.bird.money/

They are currently reviewing the underlying smart contracts and will then be switched to the mainnet.