Michael Saylor, CEO of MicroStrategy, says institutional interest in Bitcoin is in the snowball. He predicts that in the coming year, a flurry of companies will follow MicroStrategy’s leadership to acquire Bitcoin as a treasury strategy.

It is more interesting that Saylor claims contact with at least a hundred private companies that have already implemented this strategy. However, given the lack of disclosure requirements for private companies, they choose not to disclose this information.

“I think a lot of companies will be doing this in the next 12 months and you will see more announcements. Because it’s an idea whose time has come. I’ve seen a lot of interest, there are a lot of private company bosses reaching out to me and they have already done it, they just don’t make any announcements. “

Hostess Laura Shin pressed for details on these private companies. Saylor replied that their valuation ranged from hundreds of millions to companies valued in excess of a billion dollars. Although its network consists mostly of American firms, this is a pattern that is reflected across Europe, the Middle East, and the Far East.

“Sometimes billions of dollars plus. I mean billions, several billion, five hundred million, one hundred million. There are many companies in this sweet spot. In general, everyone speaks to everyone. “

$ 1.9 trillion stimulus deal in the works, cue Bitcoin as hedge

MicroStrategy was the first publicly traded company to acquire significant stakes in Bitcoin back in August 2020.

Since then, its CEO Michael Saylor has preached tirelessly about the benefits of buying Bitcoin. He’s talked at length about, and even more, why he believes it’s the piece to do in these uncertain times.

A quote from an interview with Anthony Pompliano shortly after the first takeover of MicroStrategy summarized his reasoning.

“The problem is that I have a lot of money and I’m seeing it melt … [On investors] You are smarter than me, I’m not joking, I’m serious, you are smarter than me. You knew before I knew cash was junk and you are a fool to sit on money. “

Months later, this is a message that is gaining momentum in the minds of people around the world. In addition, the threat of inflation, economic stagnation and crippling deficits becomes even more real as there is no end in sight to monetary pressure policy.

Newly elected US President Joe Biden arrived at the White House a week ago today with plans for a new stimulus package worth $ 1.9 trillion. Mainstream outlets, including the FT, despised the plans. But what else can you do to keep the system going?

“The average person understands that there is no such thing as free lunch. The road to wealth can’t be as simple as just printing and spending. If he relies on low interest rates to fund further massive increases in government spending, Mr Biden will redouble his policies, which have magnified the problems he seeks to fix: weak growth, financial instability, and increasing inequality. “

Institutional buyers’ interest in Bitcoin is a confirmation from the corporate world that the future can get hectic. The flood Saylor speaks of shows the extent to which self-preservation is becoming a priority for these companies.

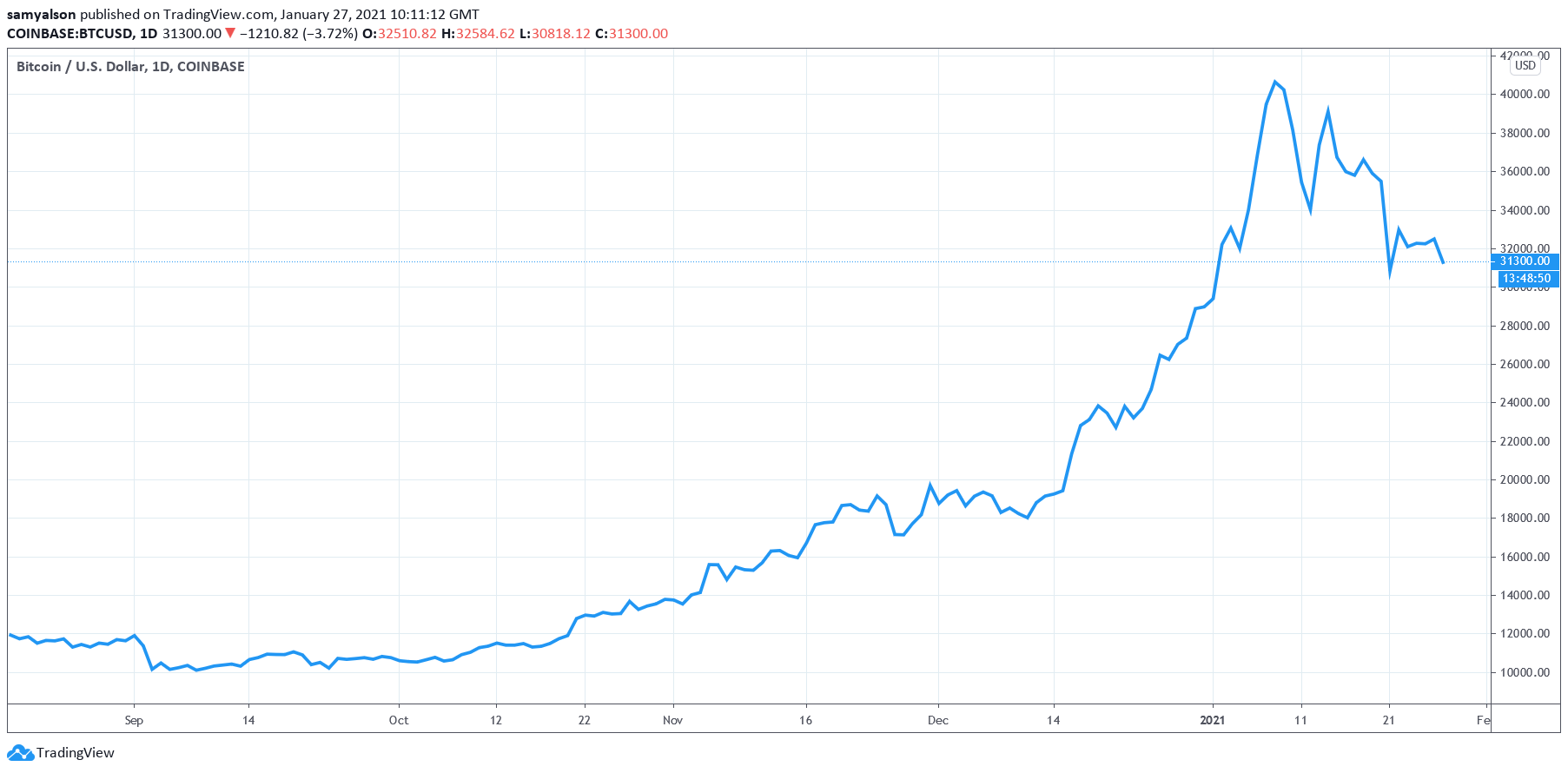

Source: BTCUSD on TradingView.com