Participation in the DeFi and Stake ecosystems has seen explosive growth over the past year. The combined sectors are currently valued at over $ 50 billion.

DeFi growth was largely driven by the groundbreaking success of Ethereum-based projects such as Aave, Compound and Uniswap, which used ERC20 stablecoins such as USDC and Dai to generate returns. Digital assets deployed in other networks lagged behind and couldn’t participate in the emerging DeFi ecosystem.

If these stakers wanted to access DeFi without bringing in new capital, they would have to scale down and sell their investments to enter the market. That meant giving up potential capital gains and wagering rewards on those assets.

The startup company RAMP DeFi from Singapore is now a pioneer in an alternative solution and opens up participation in the Ethereum-based DeFi ecosystem – without foregoing the future advantages of other digital assets. It was invested by Alameda Research, IOST and Blockwater Capital, among others.

A cross-chain liquidity on / off ramp

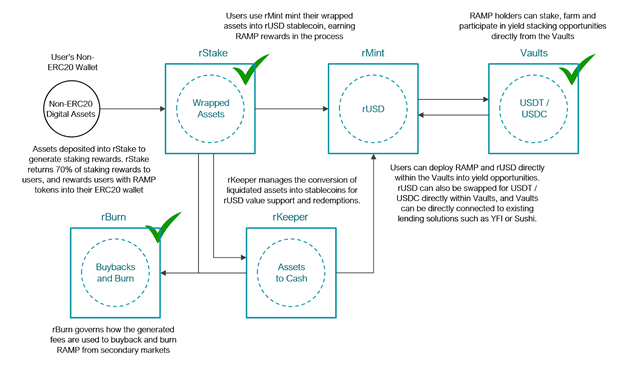

The innovative decentralized protocol solution from RAMP DeFi proposes to stabilize the capital staked on non-Ethereum blockchains in a new stable “rUSD” which is issued on Ethereum and acts as a bridge between non-ERC20 tokens and the Ethereum chain.

By lending / borrowing, bootstrapping the stability of stable coins, and integrating with other DeFi solutions, RUSD holders can either use RUSD for opportunities to generate higher returns or switch to USDT / USDC. This creates a seamless on / off ramp for users with capital in other chains to access DeFi without giving up future potential profits or rewards from the secured digital assets.

How does it work?

For each integrated blockchain “X”, a RAMP stakeout node and an intelligent contract for blockchain X are set up to manage the assets. Token X will be deployed in the RAMP ecosystem to continue receiving Blockchain X stake rewards.

A wrapped token X is then issued and used to secure and mint a native blockchain X stablecoin, xUSD. xUSD is based on a collateralization rate similar to MakerDAO.

xUSD can then be exchanged for the stable coin of the ERC20 rUSD via the cross chain bridge of the on / off ramp. From there, rUSD can be used for income cultivation purposes or exchanged directly for other stable coins using decentralized liquidity pools.

An expanding ecosystem that is gaining traction

RAMP DeFi’s liquid staking solution opens up an ecosystem of services, assets and opportunities that is already growing in importance:

rStake

rStake is the part of the ecosystem where non-ERC20 tokens are staked and packaged tokens are issued to represent ownership of the underlying assets. It is an aggregator of stakeout nodes on the participating blockchains that returns 70% of the stakeout rewards to the user and creates incentives for participation through additional RAMP governance token rewards. The remaining stake rewards generate fees for the RAMP ecosystem to improve stability.

rStake has already started integrations for the blockchains IOST, TomoChain and Tezos.

rMint

rMint uses the packaged tokens issued by rStake as security to mint a stable coin for the respective X-Blockchain (xUSD). xUSD will then be exchanged for ERC20 rUSD for use in the Ethereum DeFi ecosystem, which will generate RAMP rewards.

Early adopters include Elrond, NULS and Solana for cross-chain DeFi farming.

Vault

The Vaults utility platform for RAMP and rUSD enables the owners to set, manage and participate in revenue stacking options.

rUSD can also be exchanged for USDT / USDC directly, and Vaults can connect to existing solutions such as YFI, Uniswap or Sushi.

rKeeper

rKeeper manages the conversion of liquidated assets into stable coins for rUSD if this is necessary for value support or redemption. rKeeper converts the value of the liquidated assets in USDT / USDC to the originally minted rUSD.

RKeeper will only buy back rUSD if rUSD with USDT / USDC is less than 1: 1, which creates stability for the rUSD utility.

rBurn

The fees generated by rStake are used to buy back and burn RAMP and to withdraw tokens. rBurn was developed as a “Smart Burn” mechanism, which in turn helps to stabilize rUSD as an alternative stable coin and bridge to the Ethereum-based DeFi network.

Open defi for non-ERC20 tokens

RAMP DeFi launches a solution with the potential to free up over $ 30 billion in a previously illiquid digital asset sector that is set to quadruple with the transition to Ethereum 2.0 alone.

The RAMP ecosystem represents exciting growth potential for DeFi. It takes advantage of the existing success and opens up further possibilities for ERC20 and non-ERC20 tokens to gain access to additional revenue services. It seamlessly connects a range of digital assets to the decentralized financial market via an increasingly interoperable area, thus promoting the acceptance of DeFi.

Image by WorldSpectrum from Pixabay