Wall Street has been represented across Bitcoin in the past few months as the need for inflation hedging increased and the price of gold relatively stagnated compared to other asset classes. This was only recently confirmed when a Wall Street veteran and former White House employee launched a BTC fund with a proprietary investment of $ 25 million, showing that there is demand for the leading crypto asset.

Related Reading: Here’s Why Ethereum’s DeFi Market May Be At The Bottom

Scaramucci Kickstarts Bitcoin Fund

According to Yahoo Finance, Anthony Scaramucci, the founder of the $ 9.2 billion fund-of-funds SkyBridge Capital, has launched a Bitcoin fund to allow Registered Investment Advisers (RIAs) to invest in BTC.

SKyBridge, which will operate the fund, recently filed a Form D with the Securities and Exchange Commission for this new fund.

Founder Scaramucci poured $ 25 million of his own capital into the fund to start the fund and show that he has confidence in it.

He believes this fund will allow a greater number of investors to get exposure to BTC. The problem is that many institutional actors or even retailers find it difficult to invest in BTC.

Related reading: Tyler Winklevoss: A “tsunami” of capital is coming for Bitcoin

Wall Street Support is swelling

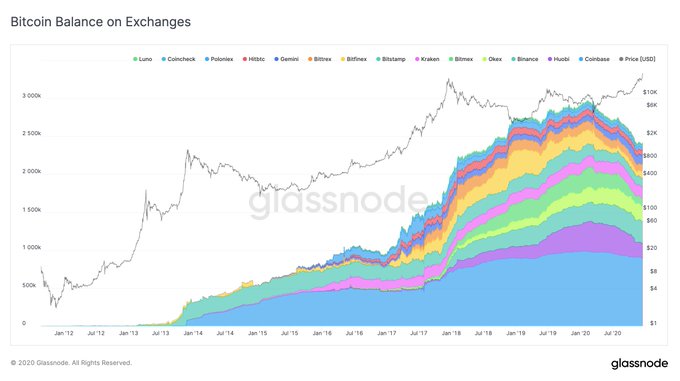

As a sign of continued support for Bitcoin on Wall Street, the number of coins on the exchanges has plummeted. Referring to the table below, Glassnode CTO Rafael Schultze Kraft recently stated:

“#Bitcoin is in a supply and liquidity crisis. This is extremely bullish! And seriously underrated. I believe we will see this clearly in the price of Bitcoin in the coming months. Let’s take a look at the data. “

Chart of the price development of BTC over the last decade with an on-chain analysis of BTC on exchanges by Rafael Schutlze Kraft, CTO of Glassnode Chart of Glassnode, a crypto data source

#Bitcoin is in a supply and liquidity crisis.

This is extremely bullish! And seriously underrated.

I believe we will see this clearly in the price of Bitcoin in the coming months.

Let’s take a look at the data.

A thread 👇👇👇 pic.twitter.com/vx6rJmiloE

– Rafael Schultze-Kraft (@ n3ocortex) December 21, 2020

A big buyer of these coins is MicroStrategy. The American business services company wrote in a press release released earlier this week that it bought $ 650,000,000 worth of BTC:

“TYSONS CORNER, Va. – (BUSINESS WIRE) – Dec. Sep. 21, 2020 – MicroStrategy® Incorporated (Nasdaq: MSTR) (the “Company”), the largest independent publicly traded business intelligence company, announced today that it has purchased approximately 29,646 additional Bitcoins for approximately $ 650.0 million in cash has Treasury Reserve Policy at an average price of approximately $ 21,925 per bitcoin, including fees and charges. “

The company believes BTC will appreciate in value over time to outperform the growth in value of its debt, as it bought those coins with debt created from the sale of senior convertible bonds.

Related Topics: 3 Bitcoin On Chain Trends Show A Macro Bull Market Is Brewing

Featured image from Shutterstock price tags: xbtusd, btcusd, btcusdt charts from TradingView.com Wall Street Veteran Kickstarts Own BTC fund with an investment of $ 25M